It’s been kicking around for a while, but the 2023 buzz word in the bookkeeping industry is advisory. What does it mean? Everyone you ask will give you a different answer. The Google definition says “Business advisory refers to the range of professional services that help businesses plan, manage, and grow their operations.” That’s great but not awfully specific. To me, business advisory is mentoring clients to understand their financials and supporting them to make decisions today to improve their business performance tomorrow. Think of advisors as the early warning systems for clients. Is it just me or is everyone imagining the Lost in Space robot screaming “Warning, Will Robinson”?

This service is particularly relevant to bookkeepers. We are smack bang in the middle of today’s client data so are perfectly placed to offer advisory, but few of us do. Whether it’s a lack of confidence or time, few bookkeepers have taken up the advisory challenge. One difficulty may be that busy bookkeeping practices, which typically focus on providing repeatable services to their clients, often don’t have the capacity to devote significant amounts of time to advisory. But I promise you, if you can eke out some time to devote to it, it’s definitely worth the effort. Clients love the extra attention, it makes them more “sticky” and it opens up a brand new income stream for your practice. Win, win.

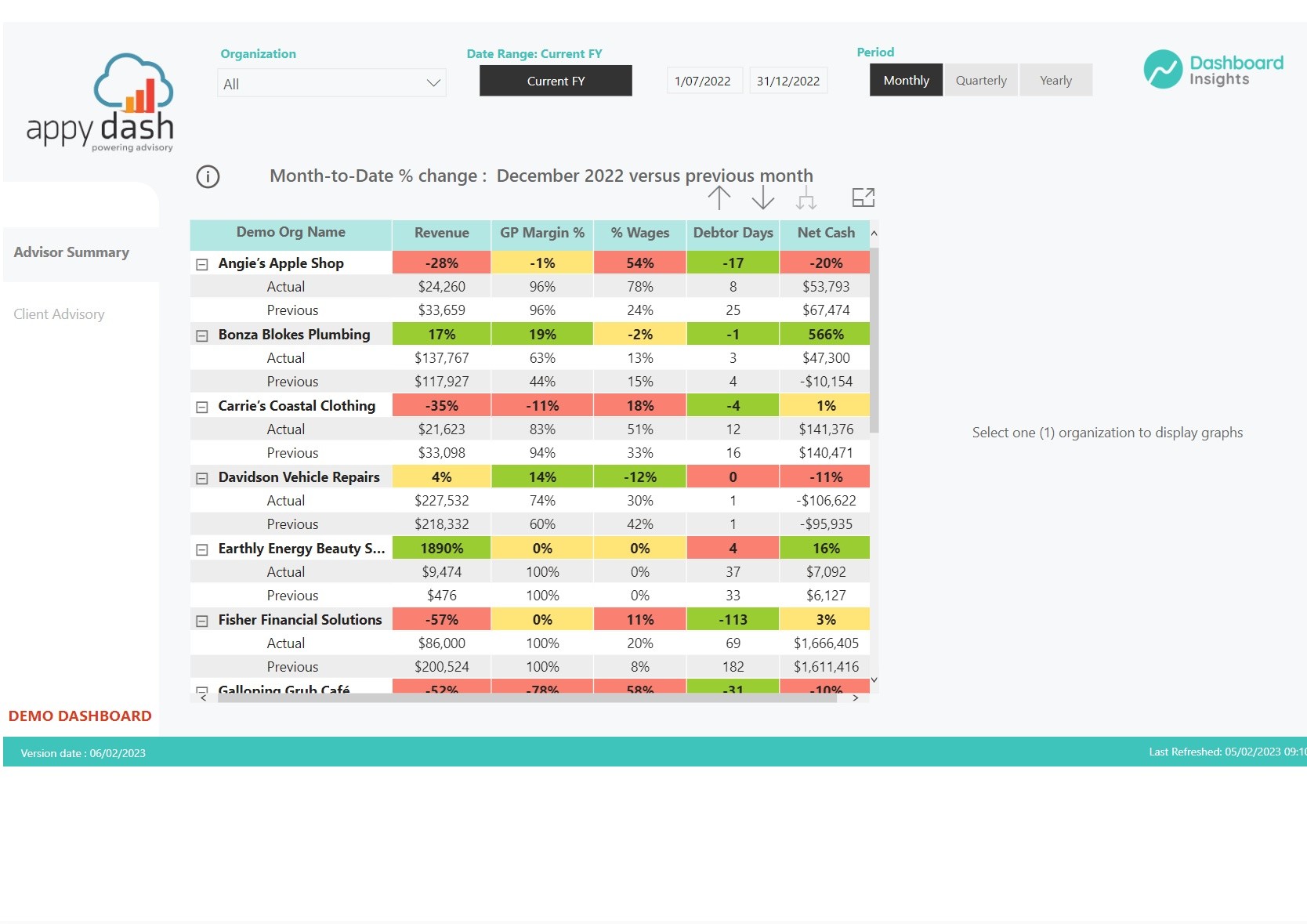

The trick is getting the method and the price right. Appy Books work with many micro clients that love attention but can’t always afford it. As part of our advisory journey, we had to find a better solution to make advisory cost effective but also worthwhile and kept everyone happy. We found, when talking to micro business owners through financial reports, that their eyes would glaze over trying to consume the detail. They were short of time and couldn’t connect. They needed something simple and snappy they could understand and focus on. This led us to combine these two thoughts and we created a set of simple financial KPIs to guide our clients. They worked great and have started many advisory conversations but they still took valuable time to prepare. We realised we had to work smarter. We needed to automate the calculations and merge the data for all Appy Books clients. So, we collaborated with the Xero App partner, Dashboard Insights, and created Appy Dash; a twin-set of dashboards that provide a practice-wide view of simple, practical KPIs for all clients as well as in-depth information to start meaningful advisory conversations, all in one place.

We are a little bit excited about the potential for this bookkeeping tool. If you are too, check out our website or book a demonstration to see what it can do for your practice advisory journey. The details are below.

https://www.appybooks.com.au/appy-dash/

https://calendly.com/appydashpoweringadvisory/demonstration-of-appy-dash